2023 International Review Letter

EARNINGS UP, VALUATION DOWN

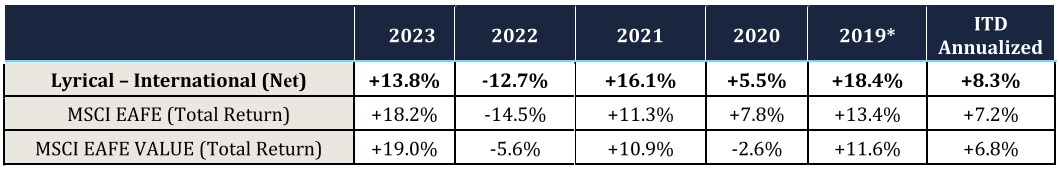

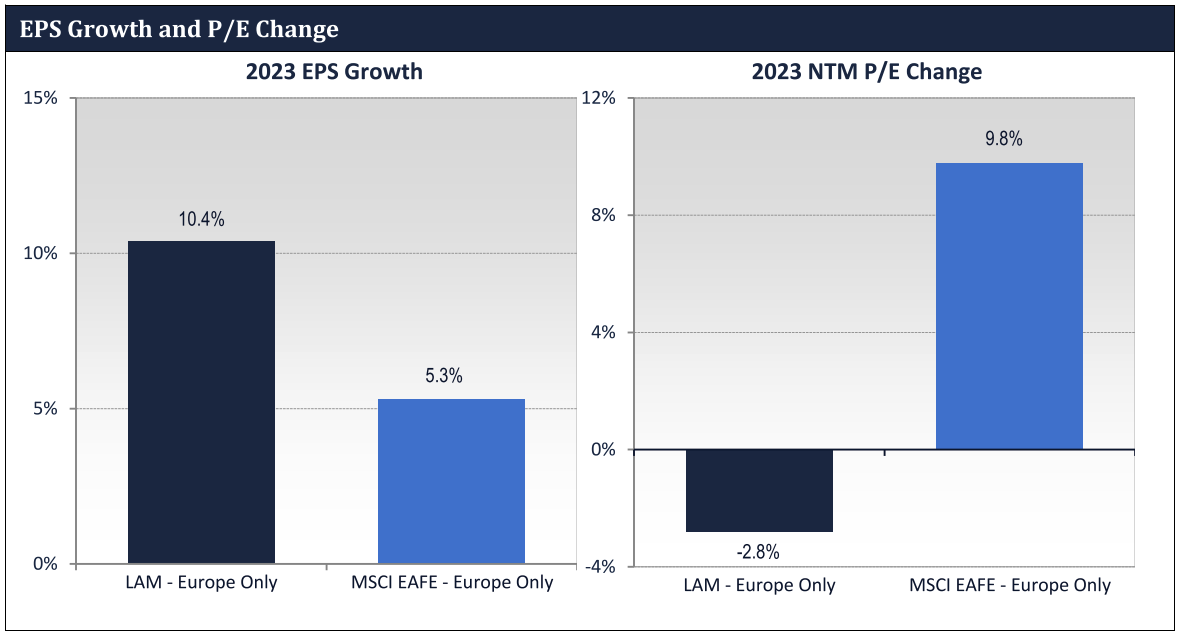

It was a healthy year for our fundamentals, even as our stocks underperformed. The forward earnings expectations for our current portfolio were good, up 9%, and better than the +6% for the EAFE and +5% for the EAFE Value.

What dampened our performance was that the P/E multiple of our portfolio expanded by just 4%, compared with 11% and 10% for the EAFE and EAFE Value, respectively. You can see this data in the table below.

Source: Factset

Source: FactsetCAP WAS THE FACTOR IN EUROPE

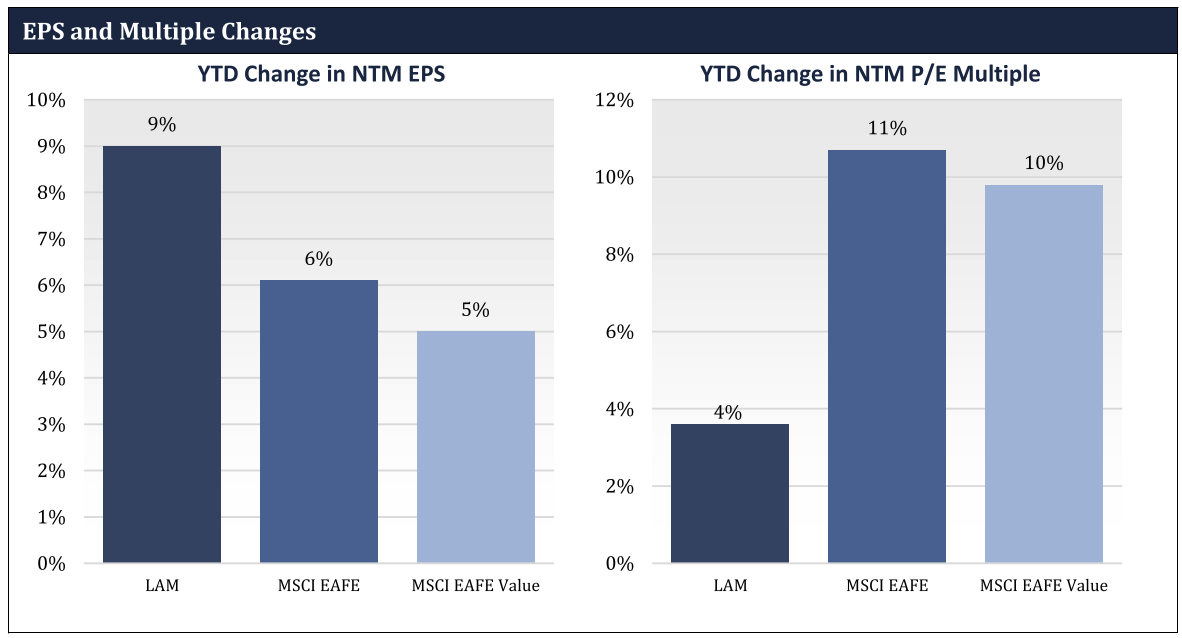

If our earnings were better, why did the indices experience double the multiple expansion? We believe the answer was the strong influence of market cap as a factor for returns in 2023 in Europe.

The largest 20% of European stocks makes up a disproportionate 41% of the MSCI EAFE, even as Europe represents only 65% of the total index. In other words, two-thirds of the European exposure in the EAFE is from the largest 20% of companies. This minority of stocks with a disproportionate index weight was a primary source of our underperformance. In our search for VQA (Value, Quality, and Analyzability), we find limited opportunities in larger-cap European names. Most of the cheap stocks within this group are in industries we avoid, like banks, commodities, and auto OEM’s, which tend to be lower quality and don’t meet our analyzability criteria.

As we show in the figure below, the largest quintile of European stocks – those with market caps greater than $40 billion, in the bar all the way to the left - were up 16% in 2023. That compares to the rest of European stocks which were up just 11%. About 40% of our European exposure is to the lower-end of our large and mid-cap universe, and this area was up only 5% in 2023, as you can see in the bar all the way to the right. This lack of exposure to the largest-cap European names drove a 350 bps headwind for us, accounting for the majority of our underperformance.

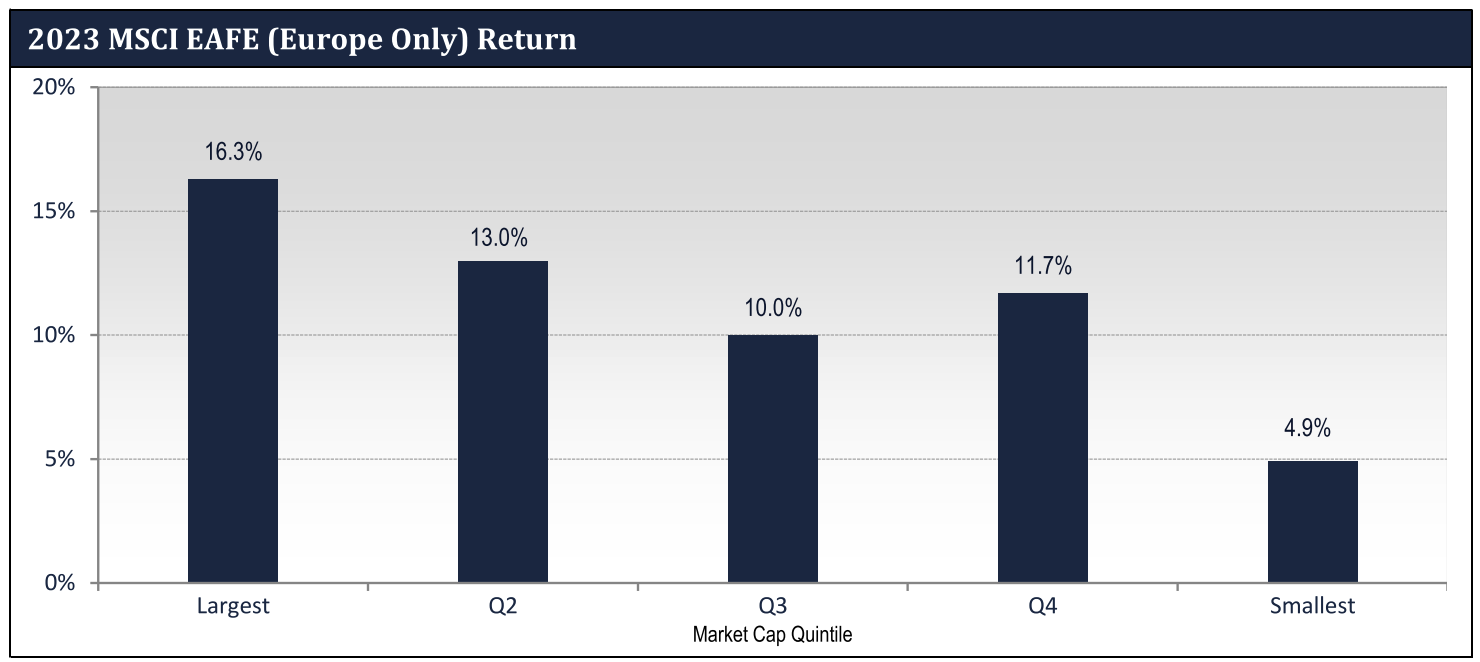

Importantly, our European companies still had strong fundamentals. In the left chart below, we see that our European companies grew earnings 10.4% during the year, nearly double EAFE’s growth rate of 5.3%. Because of the market cap headwinds, however, in the right chart we show that our European companies’ multiples compressed 2.8%, while the broader EAFE Europe expanded by 9.8%.

better earnings growth. Over short periods of time, valuation multiples can move up and down, but ultimately

valuation follows earnings. For Lyrical International, those earnings have continued to be delivered.

THE OPPORTUNITY IN INTERNATIONAL STOCKS

As bottom-up managers, we typically focus our comments on our own set of companies that have delivered attractive earnings growth at discounted valuations. But are we hunting in the right geographies? For the past decade, the U.S. equity market has significantly outperformed the non-U.S. developed market, reducing investor interest in international stocks. Are international companies slower-growing and destined to lag their US counterparts, or is the cheap valuation of the EAFE, today, a buying opportunity?

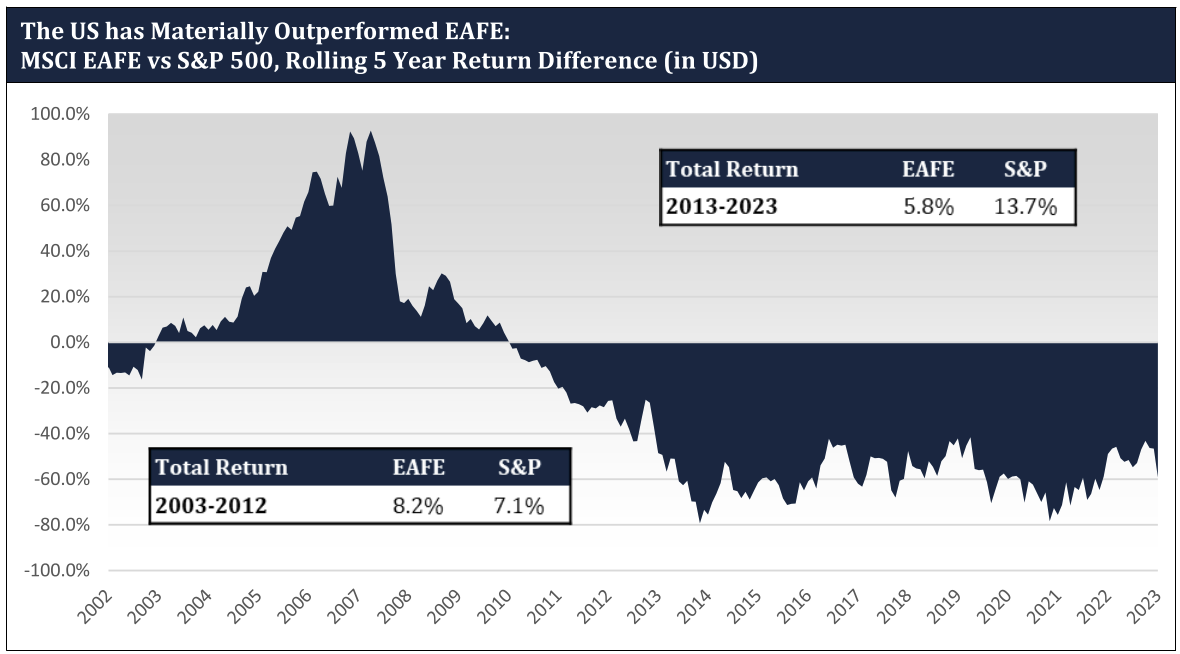

We believe international stocks are unpopular today largely because they have produced weaker returns over the past ten years. Below, we show the rolling five-year trailing return difference between the EAFE and the U.S. When the bars are positive, as they were from 2003 to 2010, International outperformed the U.S. When the bars are negative, that means International underperformed the U.S. Over the past decade, the EAFE benchmark has underperformed by almost 8% per year.

This persistent underperformance of international stocks makes them easy to ignore. However, avoiding international markets only makes sense to us if the poor returns have come from weak fundamentals, and this simply has not been the case.

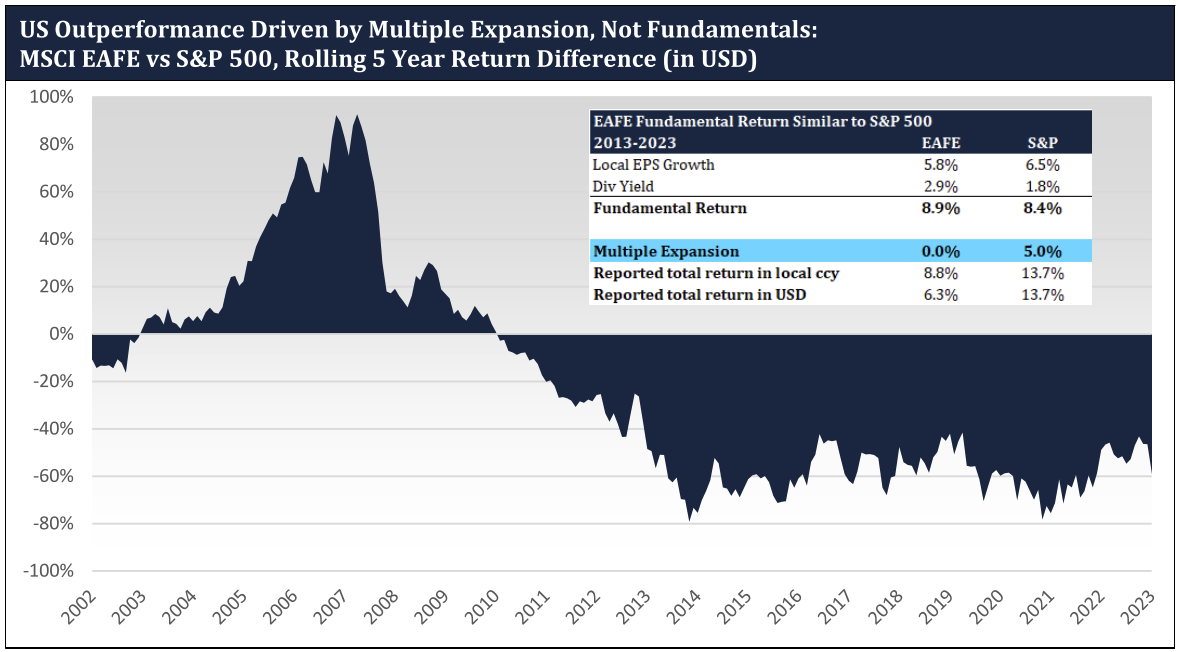

Over the past ten years, international companies have had good fundamentals. The total return from an index or a stock can be broken down into three components: the return from fundamentals, the return from valuation, and the return from currency. The fundamental return is the amount of money you make from a company growing its earnings and the dividends you receive. As you can see from the table below, at the top right, over the past decade the international market has delivered a fundamental return of 8.9% per year, better than the 8.4% from the S&P 500.

In other words, over the past ten years the S&P 500 total return has trounced the EAFE’s by more than 8%, and yet the fundamental drivers of return have been about the same.

If the companies outside the U.S. have been just as good fundamentally as their U.S. counterparts, how can we explain this huge outperformance by U.S. stocks? As highlighted in blue above, the U.S. outperformance has been driven by companies getting more expensive, not by companies growing faster. Multiple expansion has benefited the S&P 500 by 5% per year, while the EAFE multiple has remained the same. Investors have been willing to pay more for U.S. stocks, but this has not been supported by better fundamental growth.

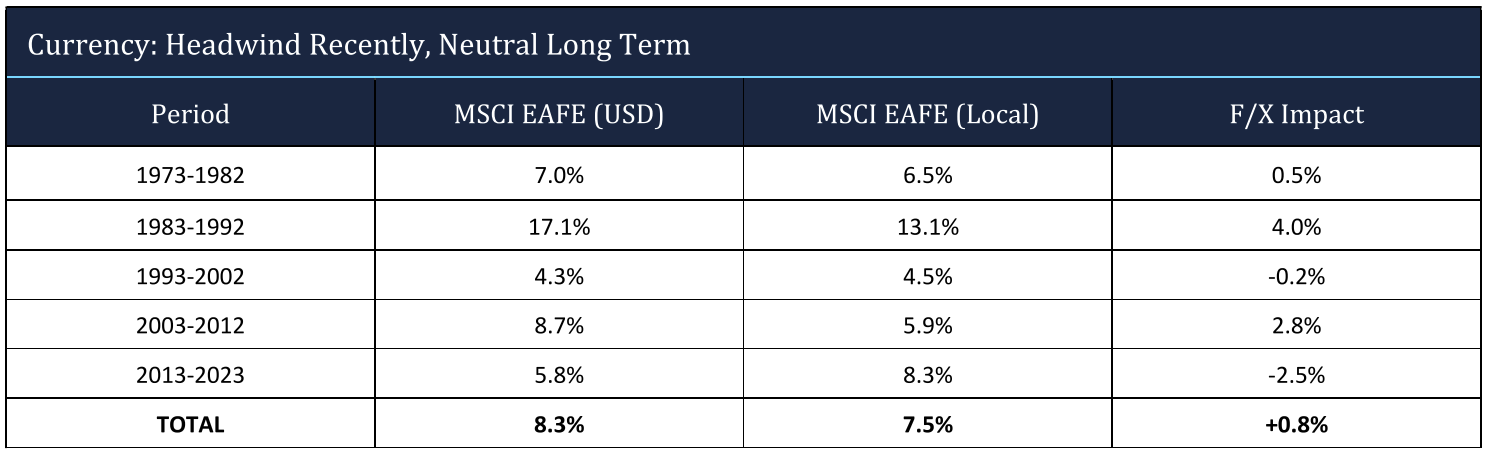

The other drag for international stocks over the past decade has been currency, which reduced international returns by 2.5% per year over this period. Currency has been a headwind for international markets over the past decade, but historically it has had a more neutral impact. In the right column of the table below, we show the tailwind or headwind from currency from investing in developed international markets over the long term. Since the early 1970’s, foreign exchange has actually been a slight benefit. However, the main point here is that developed market international currencies ebb and flow relative to the U.S. dollar. Just like with valuation multiples, we expect that the significant negative drag from currency over the past decade is unlikely to repeat.

Source: Factset.

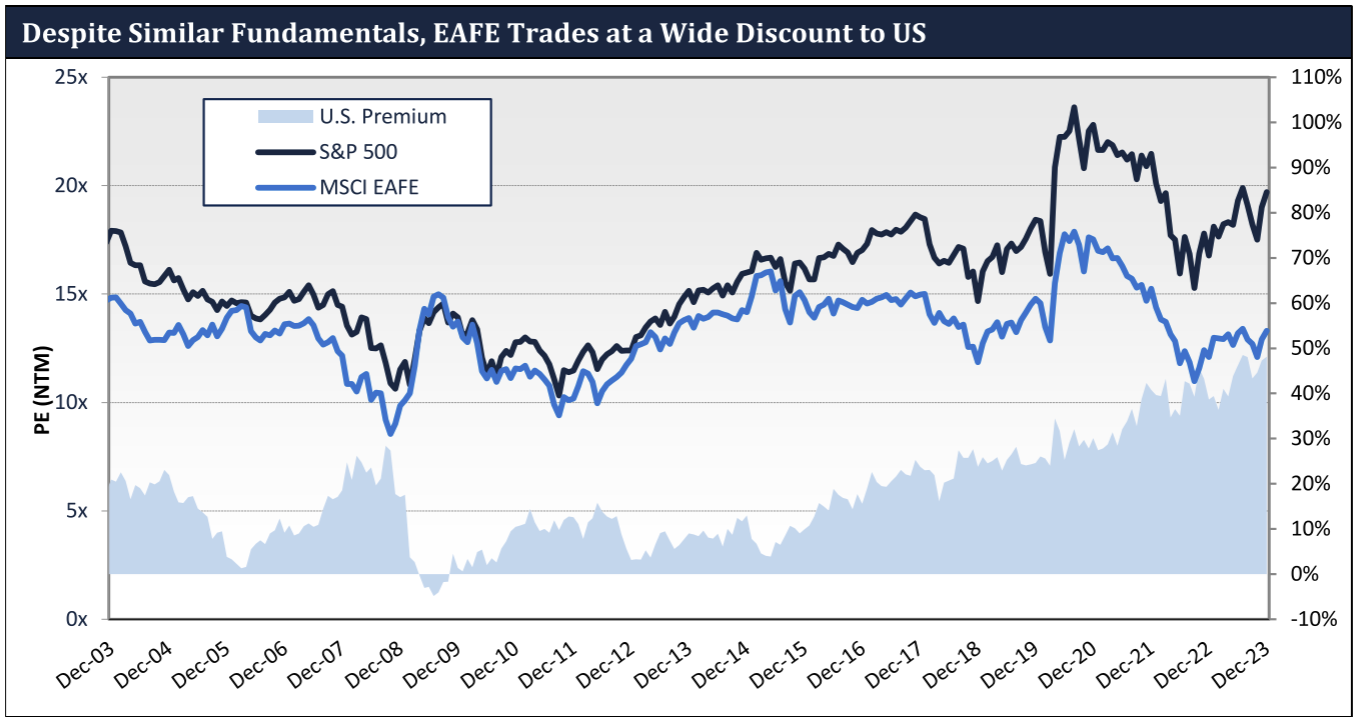

Source: Factset. Because U.S. stocks have appreciated much more than international stocks despite similar fundamentals, the valuation spread between the two markets has expanded to we believe an extreme level. This slide shows the P/E multiple for the S&P 500 in the black line and the EAFE in the blue line. The bars at the bottom show the spread, or how much more expensive the S&P 500 is relative to the EAFE.

Source: Factset.

Source: Factset.

There are a few points to make here. First, on an absolute basis, the EAFE is clearly cheaper. It trades just above 13x earnings, similar to the multiple reached at the bottom of the COVID collapse in 2020 and at a 7% discount to its 10-year average. The S&P 500, on the other hand, looks expensive. It trades at 20x earnings, near its historic highs, and an 11% premium to its 10-year average.

The bars at the bottom show that the S&P 500 is nearly 50% more expensive today than the EAFE, a wider premium than we’ve seen going back 20 years to 2003. Again, this is despite the fact that the fundamentals for the EAFE have been just as attractive.

THE OPPORTUNITY IN LYRICAL’S INTERNATIONAL STOCKS

With similar fundamentals to the U.S. at a much cheaper price, we think the international markets present an excellent hunting ground for bottom-up stock pickers.

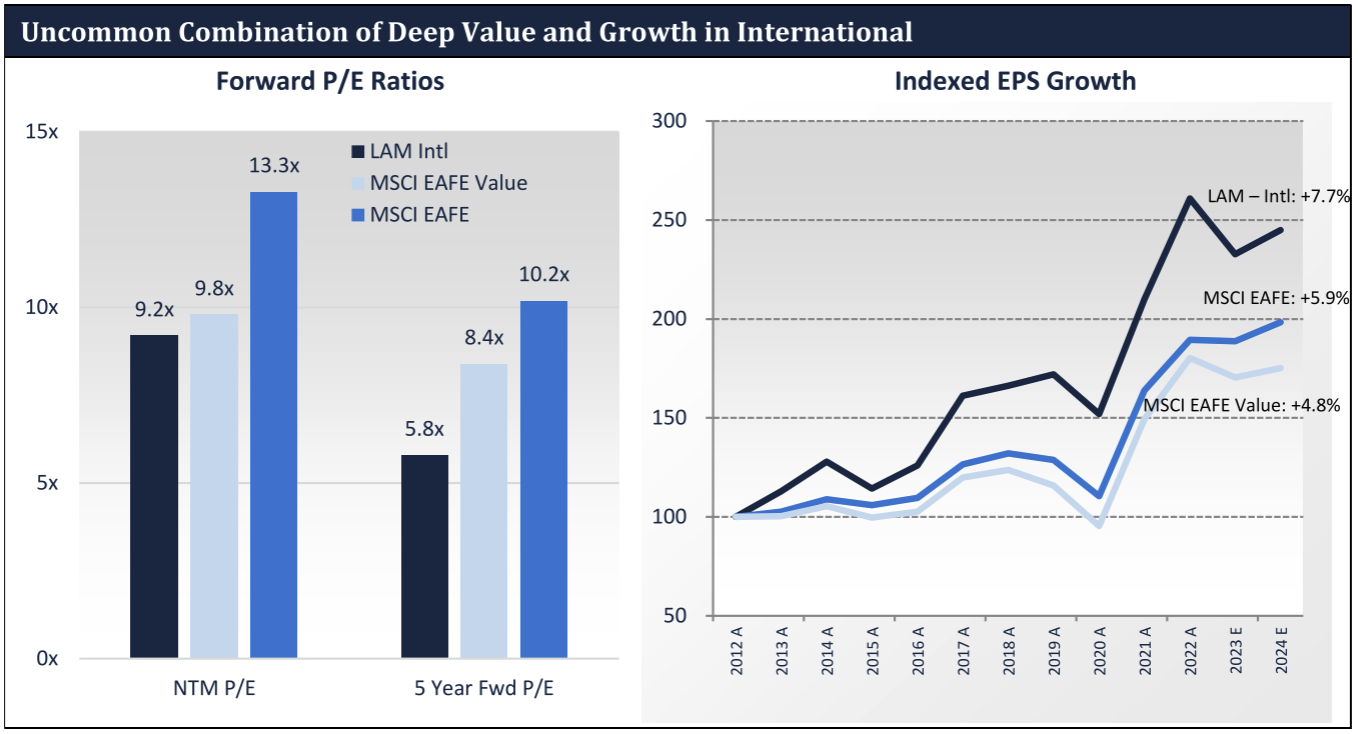

As shown below, our portfolio ended the year at only 9.2x forward earnings despite our companies compounding earnings at a 7.7% rate over the past decade through to 2024 estimates. This is near the cheapest our portfolio has been since we launched the strategy in 2019. And from an earnings perspective, the portfolio shows superior fundamentals on both long-term growth and resilience during recessions.

Source: Factset.

Source: Factset.

CONCLUSION

As much as we are frustrated to have lagged the EAFE in 2023, we are excited that our companies have delivered better earnings growth. In a year with recession fears hovering over Europe, investors favored the largest-cap, more expensive businesses. Despite these macro concerns, our European companies grew EPS 10%, proved their resilience once again, and ended the year cheaper (based on forward P/E multiples) than before.

We’d rather have strong fundamentals AND strong performance, but if we keep delivering good fundamentals we think it’s reasonable to expect that returns will follow. Riding the wave of a U.S. market dominated by mega-cap tech has worked well for a long time. It is easy to miss that those great U.S. returns have come mostly from stocks getting more expensive, and it’s easy to miss the opportunity in international stocks today.

We live in the trenches of value investing, and what we see today is the international market is near the cheapest point that it’s been relative to the U.S. in over 20 years. At the same time, our stocks are near their cheapest relative valuation, despite superior growth. In short, we see the current opportunity set in international value as one of the best of our careers, and we look forward to harvesting future gains with our investors.

We thank you for your confidence, and, as always, we welcome your inquiries.

Co-Portfolio Managers

General:

We do not attempt to time the markets or focus on weightings relative to any index. Accordingly, client returns are expected, at certain times, to significantly diverge from those of market indices.

Investing in securities involves a risk of loss that investors must be prepared to bear. Because we invest primarily in publicly traded equity securities, Lyrical believes the primary risk of loss is associated with securities selection and broad market movements, and wide and sudden fluctuations in market value can occur.

Force Majeure. Lyrical and its clients may be affected by force majeure events (i.e., events beyond the control of the party claiming that the event has occurred, including, but not limited to, acts of God, fire, flood, earthquakes, outbreaks of an infectious disease, pandemic or any other serious public health concern, war, terrorism, labor strikes, major plant breakdowns, pipeline or electricity line ruptures, failure of technology, defective design and construction, accidents, demographic changes, government macroeconomic policies, social instability, etc.). Some force majeure events may adversely affect the ability of a party (including a portfolio company or service provider) to perform its obligations until it is able to remedy the force majeure event. These risks could, among other effects, adversely impact the cash flows available from a portfolio investment, cause personal injury or loss of life, damage property, or instigate disruptions of service. In addition, the cost to a portfolio company or a client of repairing or replacing damaged assets resulting from such force majeure event could be considerable. Force majeure events that are incapable of or are too costly to cure can have a permanently adverse effect on a portfolio company. Certain force majeure events (such as war or an outbreak of an infectious disease) could have a broader negative impact on the world economy and international business activity generally, or in any of the countries in which we invest.

International Risks:

International holdings involve risks and considerations not typically associated with investing in U.S. companies. The performance of foreign markets does not necessarily track U.S. markets. Foreign investments may be affected favorably or unfavorably by changes in currency rates and exchange control regulations. There may be less publicly available information about a foreign company than about a U.S. company, and foreign companies may not be subject to accounting, auditing and financial reporting standards and requirements comparable to those applicable to U.S. companies. Foreign securities often trade with less frequency and volume than domestic securities and therefore may exhibit less liquidity and greater price volatility than securities of U.S. companies. There may be less governmental supervision of securities markets, brokers, and issuers of securities than in the U.S. Changes in foreign exchange rates will affect the value of those securities, which are denominated or quoted in currencies other than the U.S. dollar. Therefore, for foreign securities which are denominated or quoted in currencies other than the U.S. dollar, there is a risk that the value of such security will decrease due to changes in the relative value of the U.S. dollar and the securities’ underlying foreign currency. Additional costs associated with an investment in foreign securities may include higher custodial fees than those applicable to domestic custodial arrangements, generally higher commission rates on foreign portfolio transactions, and transaction costs of foreign currency conversions. Investments in foreign securities may also be subject to other risks different from those affecting U.S. investments, including local political or economic developments, expropriation or nationalization of assets, restrictions on foreign investment and repatriation of capital, imposition of withholding taxes on dividend or interest payments, currency blockage (which would prevent cash from being brought back to the U.S.), limits on proxy voting and difficulty in enforcing legal rights outside the U.S. Currency exchange rates and regulations may cause fluctuation in the value of foreign securities. In addition, foreign securities and dividends and interest payable on those securities may be subject to foreign taxes, including taxes withheld from payments on those securities.

“Fair and balanced” assessment:

You are entitled to a fair and balanced presentation, to inform any decision about investing with us. And, no such decision should be based entirely or predominantly on information in this document. By design, our investment approach differs from the norm in important ways. While those differences are intentional and, we believe, well-founded, we allow that those who act more conventionally, too, have reasons for doing so. We strongly encourage that you engage with our client service team to better understand our beliefs and our methods. Questions could be as general as “why value?” or as narrow as “why do you not conviction-weight positions?” for just two examples. Even as our strategies offer liquidity, we seek an alignment of long-term minded investors and our long-term orientation; the better you are informed, the more likely that match will be made.

DISCLAIMERS:

General:

Past performance is not necessarily indicative of future results. Individual results may vary based on timing of investments and/or other factors. There is no guarantee that the investment objective of our strategy will be achieved.

This document is confidential and does not convey any offering or the solicitation of any offer to invest in the strategy presented. Any such offering can only be made following a one-on-one presentation, and only to qualified investors in those jurisdictions where permitted by law.

The information included in this document is not being provided in a fiduciary capacity, and it is not intended to be, and should not be considered as, impartial advice.

“Forward-looking statements” contained herein can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, or assurance or as a representation as to the future.

Certain information contained herein has been obtained from third party sources and not independently verified by Lyrical. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information. While such sources are believed to be reliable, Lyrical does not assume any responsibility for the accuracy or completeness of such information. Lyrical does not undertake any obligation to update the information contained herein as of any future date.

More complete information about our products and services is contained in our Form ADV, Part 2

Registration with the SEC does not imply a certain level of skill or training.

Disclosed holdings:

Lyrical disclaims any duty to update historical information included herein, including whether we continue to hold positions that are mentioned. In the interest of our clients, reporting as to positions in transition (being purchased or sold) is lagged at our discretion. Generally, securities which have not been purchased for all accounts are not reflected as held and sales of positions which remain in any client accounts similarly are not reflected.

Specific investments described in this document do not represent all investments by Lyrical. You should not assume that investment decisions we include were or will be profitable. Specific investment examples are for illustrative purposes only and not necessarily representative of investments that will be made in the future. A list of all prior investment recommendations is available upon request.

Model or hypothetical performance:

Where we provide information about performance that is not the actual performance results of our investment strategies (such as where we show the results of price-to-earnings quintiles), please note that there are substantial additional limitations inherent in using such performance information. Those include, but are not limited to, that actual trading and the associated expenses did not occur, that market conditions change over time, and that no investor had the actual performance presented.

IMPORTANT NOTES:

Index Information:

Any indexes and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from those of Lyrical’s strategies.

The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 developed market countries around the world, excluding the US and Canada. With 918 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characteristics across Developed Markets countries around the world, excluding the US and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

EPS and Multiple Changes

The three charts showing change in earnings per share depict the historical change of earnings per share of the companies comprising the LAM International portfolio as of December 31, 2023 using current composite share holdings as of that date, except the second such chart applies the same methodology to the subset of the LAM International portfolio comprised of European companies. These charts also show the change in earnings per share of the MSCI EAFE Index and MSCI EAFE Value Index over the same period. Earnings per share is computed using consensus earnings data, which include certain adjustments from reported, GAAP earnings. Periods marked with an “E” include estimated earnings per share. LAM International portfolio holdings are included from the earliest date of their available data.